FreshBooks – Small Business Invoicing – FreshBooks stands out as a powerful solution tailored for small businesses seeking efficient invoicing options. This cloud-based accounting software is designed to simplify financial processes, enabling business owners to focus on their core activities while ensuring they get paid promptly. With its intuitive features and a history of continuous evolution, FreshBooks has become a go-to choice for entrepreneurs looking to enhance their financial management.

In a world where time is money, FreshBooks empowers users by streamlining invoicing and providing tools that cater specifically to the needs of small business owners. From its comprehensive features to its seamless integrations, FreshBooks delivers a robust platform that adapts to the changing dynamics of modern business.

Overview of FreshBooks: FreshBooks – Small Business Invoicing – FreshBooks

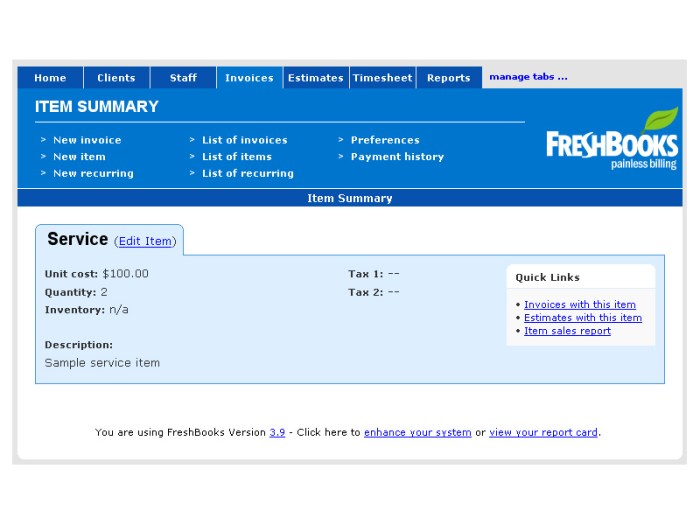

FreshBooks is a cloud-based accounting software designed specifically to meet the invoicing needs of small businesses. Its primary purpose is to simplify the invoicing process, allowing users to create, send, and manage invoices quickly and efficiently. FreshBooks caters to freelancers, small business owners, and professionals across various industries, providing essential tools that streamline financial management and improve overall productivity.

Since its inception in 2003, FreshBooks has evolved significantly. Originally a simple invoicing tool, it has expanded its features to include comprehensive accounting functions, time tracking, and expense management. This evolution has been driven by user feedback and the growing demands of small business environments, making FreshBooks a reliable solution for modern entrepreneurs.

Features of FreshBooks

FreshBooks stands out in the crowded field of invoicing software due to its unique features tailored to small business needs.

- Intuitive Interface: The user-friendly design ensures that even non-technical users can navigate the platform with ease.

- Time Tracking: Users can track billable hours directly within the platform, improving accuracy in invoicing.

- Customizable Invoices: FreshBooks allows users to personalize their invoices with logos and color schemes, enhancing branding efforts.

- Recurring Billing: Small businesses can set up automatic billing for regular clients, saving time and reducing administrative tasks.

Time tracking within FreshBooks is straightforward, enabling users to start and stop timers while working on projects. This feature not only ensures accurate billing but also allows business owners to better understand how their time is spent, ultimately leading to improved productivity.

The invoicing capabilities of FreshBooks are robust, allowing for detailed itemization and the option to include payment terms. Customization options enable users to create invoices that reflect their brand identity, fostering professionalism in client communications.

Benefits for Small Businesses

Utilizing FreshBooks offers several advantages for small businesses compared to traditional invoicing methods.

- Efficiency: Automated processes reduce the time spent on administrative tasks, allowing business owners to focus on core activities.

- Improved Cash Flow: Timely invoicing and follow-up features help in receiving payments faster, improving cash flow management.

- Accessibility: As a cloud-based solution, FreshBooks enables users to access their financial data from anywhere, making it convenient and flexible.

Testimonials from small business owners highlight the positive impact of FreshBooks. For instance, a freelance graphic designer reported a significant increase in timely payments after switching to FreshBooks, attributing this change to the software’s efficient invoicing features.

Integration with Other Tools

FreshBooks integrates seamlessly with various applications and tools, enhancing its functionality and workflow efficiency.

- Payment Processors: Integrations with PayPal, Stripe, and Square allow users to accept online payments easily.

- Project Management Tools: Integrating with platforms like Asana and Trello helps streamline project tracking and invoicing processes.

- Accounting Software: Connections with systems like QuickBooks and Xero enable users to maintain accurate financial records effortlessly.

Integrations are crucial for small businesses as they enhance workflow efficiency, reduce duplication of efforts, and ensure accurate data across platforms.

| Integration | Benefits |

|---|---|

| PayPal | Enables quick online payments directly from invoices. |

| Asana | Helps manage projects while keeping invoicing linked to project timelines. |

| Stripe | Facilitates easy credit card payments on invoices. |

Pricing Structure

FreshBooks offers several pricing plans designed to accommodate various business sizes and needs. The plans typically include features ranging from basic invoicing to advanced reporting and project management tools.

- Lite Plan: Ideal for freelancers, includes essential invoicing features for up to 5 clients.

- Plus Plan: Suitable for growing businesses, allows invoicing for unlimited clients and includes additional features like recurring billing.

- Premium Plan: Designed for established businesses with advanced reporting and priority support features.

When compared to other small business invoicing solutions in the market, FreshBooks provides a competitive pricing structure that delivers significant value through its comprehensive features and exceptional user experience.

User Experience and Interface

The user interface of FreshBooks is designed with accessibility in mind, allowing non-technical users to navigate the platform effortlessly. The dashboard provides a clear overview of financial health, with easy access to invoicing, expenses, and reports.

User experiences reflected in online reviews consistently highlight the ease of use and intuitive design as key strengths of FreshBooks. Many users appreciate how quickly they can generate invoices and track payments without a steep learning curve.

To navigate the FreshBooks dashboard effectively, follow these steps:

1. Log in to your FreshBooks account.

2. Explore the dashboard overview to see key financial metrics.

3. Use the navigation menu to access features like invoices, expenses, and reports.

4. Click on any feature to dive deeper into specific functionalities.

Customer Support and Resources

FreshBooks provides various customer support options, ensuring users have access to help when needed. Support methods include email assistance, live chat, and a comprehensive help center.

A wealth of resources is available for users, including detailed tutorials, webinars, and community forums. These resources empower small business owners to maximize their use of FreshBooks and enhance their financial management.

Customer support is critical for small businesses using financial software like FreshBooks. Prompt and effective assistance can make a significant difference in resolving issues and maintaining smooth operations.

Security and Data Protection, FreshBooks – Small Business Invoicing – FreshBooks

FreshBooks prioritizes the security of user data through multiple layers of protection, including data encryption and secure cloud storage. These measures ensure that sensitive financial information remains safe from unauthorized access.

Data protection is essential for small businesses using invoicing software, as it safeguards against potential financial loss and identity theft. FreshBooks’ commitment to security allows users to operate with confidence.

“I feel secure knowing that my financial data is protected by FreshBooks’ top-notch security features. I’ve never had concerns about data breaches.” – A satisfied FreshBooks user