TurboTax Deluxe – Tax Preparation – Intuit is a powerful tool designed to simplify the often daunting task of filing taxes. With its user-friendly interface and robust features, it appeals to a wide range of individuals, from first-time filers to seasoned taxpayers. This guide will explore the unique aspects of TurboTax Deluxe, highlighting its advantages over other versions, the step-by-step preparation process, and the essential support available for users.

As we delve deeper, you’ll discover how TurboTax Deluxe streamlines your tax preparation experience, ensuring that you gather necessary documents seamlessly and navigate the interface with confidence. We’ll also touch on the benefits that make it a preferred choice, including its reliability and accuracy in calculations, setting the stage for a stress-free tax season.

Overview of TurboTax Deluxe

TurboTax Deluxe offers a comprehensive solution for individuals looking to streamline their tax preparation process. This version is designed with various features that cater to the needs of users, providing a user-friendly experience while ensuring accuracy in tax filing. TurboTax Deluxe is particularly aimed at individuals with more complex tax situations, including homeowners, families with children, or those who wish to maximize their deductions.

Main Features of TurboTax Deluxe

TurboTax Deluxe includes several key features that set it apart:

- Deduction Maximizer: This feature helps identify potential deductions that users may qualify for, ensuring they receive the maximum refund possible.

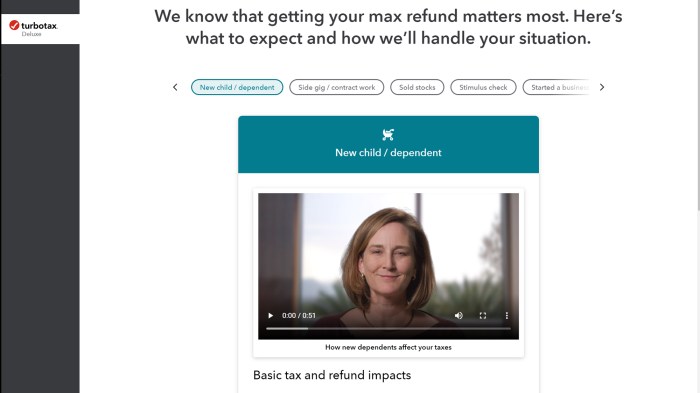

- Step-by-Step Guidance: Users are guided through the tax preparation process with easy-to-follow prompts and explanations.

- Importing Capabilities: Users can import W-2s and 1099s directly from their employers and financial institutions, reducing data entry errors.

- Real-Time Refund Tracker: Track the status of your refund as you complete your tax return.

Target Audience for TurboTax Deluxe

TurboTax Deluxe primarily targets individuals and families with moderate to complex tax situations. This includes:

- Homeowners looking for property tax deductions.

- Families with dependents who want to maximize tax credits.

- Individuals with itemized deductions, such as charitable contributions or medical expenses.

Differences Between TurboTax Deluxe and Other TurboTax Versions

TurboTax Deluxe differs from other versions like TurboTax Free and TurboTax Premier primarily in its features and intended use:

- TurboTax Free: Best for simple returns with no itemized deductions.

- TurboTax Premier: Geared towards investors and those with rental properties, offering additional investment-related features.

Tax Preparation Process

The tax preparation process using TurboTax Deluxe is designed to be intuitive and efficient, allowing users to complete their filings with ease.

Step-by-Step Process of Using TurboTax Deluxe

The process generally follows these steps:

- Sign in or create an account on the TurboTax website.

- Choose the TurboTax Deluxe option and start your return.

- Answer questions about your personal information and income sources.

- Utilize the deduction maximizer feature to identify eligible deductions.

- Review your return and submit electronically or print it for mailing.

Gathering Necessary Documents and Information

Preparing for tax season requires gathering specific documents:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, including medical and charitable contributions.

- Records of any investments or rental properties.

Navigating the TurboTax Interface

TurboTax Deluxe features a user-friendly interface with easy navigation. Users can:

- Use the “What do I need to do next?” feature to understand the next steps.

- Access help articles and FAQs directly within the interface.

- Easily jump between sections using the sidebar navigation.

Key Benefits of Using TurboTax Deluxe

TurboTax Deluxe presents several advantages over traditional manual tax preparation methods.

Advantages Over Manual Tax Preparation

Using TurboTax Deluxe offers substantial benefits:

- Time Efficiency: The software automates calculations, reducing the time required to complete tax returns.

- Guidance: Step-by-step instructions help users avoid common pitfalls associated with manual preparation.

Money-Saving Features

TurboTax Deluxe includes several features that can save users money:

- Maximizing Refunds: The deduction maximizer can uncover potential tax savings.

- Free e-Filing: Users can file their taxes electronically at no additional cost.

Accuracy and Reliability of Calculations

The software is built to ensure accuracy:

TurboTax Deluxe performs calculations automatically and cross-checks entries for potential errors, providing peace of mind for users.

User Experience and Interface

TurboTax Deluxe is designed with the user in mind, making tax preparation accessible for all skill levels.

User Interface Design

The interface is clean and organized, featuring a logical flow that guides users through the tax preparation steps. Key elements include:

- A comprehensive dashboard that summarizes progress.

- Clear visual indicators of completed sections.

User-Friendly Features

TurboTax Deluxe enhances user experience with:

- Help icons that provide immediate assistance on challenging topics.

- Customized tips based on user inputs to improve tax filing accuracy.

Accommodating Various User Skill Levels

TurboTax Deluxe is suitable for both novice and experienced users, offering:

- Simple language and explanations for beginners.

- Advanced options for experienced filers to dive deeper into deductions and credits.

Support and Resources

TurboTax Deluxe users have access to a variety of support options to assist them through the tax preparation process.

Customer Support Options

TurboTax provides several support channels, including:

- Live chat with customer service representatives.

- Phone support for direct assistance.

Accessing Online Resources and Tutorials

TurboTax Deluxe offers extensive online resources:

- A dedicated help center with FAQs.

- Video tutorials that walk users through common tasks.

Common Troubleshooting Tips

Users may encounter issues, but common solutions include:

- Clearing browser cache if experiencing loading issues.

- Ensuring all required documents are uploaded before submitting.

Pricing and Value

Evaluating the pricing of TurboTax Deluxe against competitors highlights its value proposition.

Pricing Structure Comparison

TurboTax Deluxe is competitively priced compared to alternatives, making it a strong contender:

- Typically lower than H&R Block’s comparable offerings.

- Offers features that justify the price, particularly for complex tax situations.

Promotional Offers or Discounts

TurboTax often provides promotional discounts during tax season, which may include:

- Reduced prices for early filers.

- Discounts for returning customers.

Value Proposition of Using TurboTax Deluxe

The value of TurboTax Deluxe can be assessed through:

Its combination of features, ease of use, and reliable support making it a worthwhile investment for stress-free tax preparation.

Customer Reviews and Feedback: TurboTax Deluxe – Tax Preparation – Intuit

Understanding customer experiences is vital for assessing the effectiveness of TurboTax Deluxe.

Themes in Customer Reviews

Common themes in customer feedback include:

- Ease of use: Many users appreciate the intuitive interface.

- Comprehensive guidance: Users often highlight the thorough explanations provided throughout the process.

Pros and Cons Mentioned by Users

Feedback often reveals:

- Pros: User-friendly interface, detailed support, and accurate calculations.

- Cons: Some users find the cost higher than expected for certain features.

Comparative Analysis of Customer Satisfaction

When comparing customer satisfaction among different TurboTax versions:

- TurboTax Deluxe generally ranks higher due to its additional features for complex tax situations.

- Users of the free version report more limitations, leading to lower satisfaction ratings.

Security Features

TurboTax Deluxe prioritizes user data protection through various security measures.

Security Measures for User Data Protection

The software employs multiple layers of security:

- Encryption of sensitive data during transmission and storage.

- Multi-factor authentication to enhance account security.

Ensuring Confidentiality of Sensitive Information

TurboTax Deluxe safeguards user information through:

- Strict privacy policies that restrict access to personal data.

- Regular security audits to ensure compliance with industry standards.

Importance of Data Security in Online Tax Preparation Tools, TurboTax Deluxe – Tax Preparation – Intuit

Data security is critical in online tax preparation, as users share sensitive information.

TurboTax Deluxe’s robust security measures provide users with the confidence to complete their tax filings without compromising their privacy.